YetiXing

Confused about dryer sheets

First time post...

Looking for input on our plan...

Really, the withdrawal strategy I have in place...

A few details, we will retire at H53/W54

All debts paid off...college, house, cars etc...

Our plan is to pull the trigger in 1.5 years when our youngest graduates college.

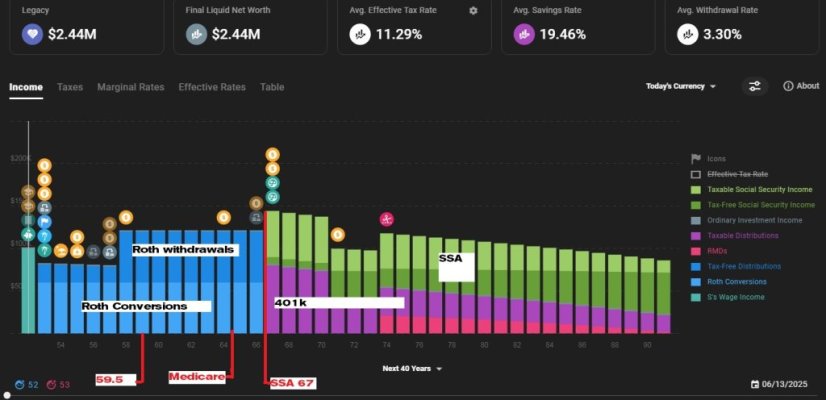

Assets 1.8m (500k cash / 200k Roth's / 1.1m 401k's)

Expenses 70k

Healthcare = ACA

SSA at 67years

My biggest question is my Roth conversion plan.

Since we will have no income from approx 53- 65...

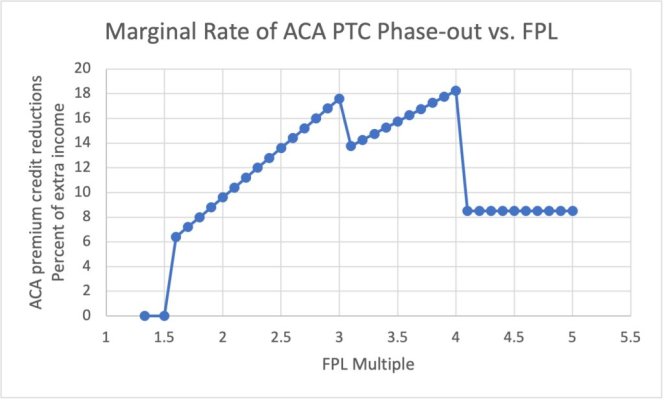

We plan to use the ACA for insurance.

-This will be accomplished by making approx 60k Roth conversions annually from 53-65 to show income... (pay the tax from cash reserves)

-We will fill the first "5 year gap" $ with Cash and existing (older) Roth CONTRIBUTION withdrawals...

-In year 6, approx 59/60 we will begin to withdraw the Roth Ladder CONTRIBUTIONS, year by year as they mature until 65...

-At that point we will switch to 401k withdrawals for living expenses, and hold the remaining Roth conversions.

-And of course at 65 medicare kicks in... And SSA at 67.

Ive tested in a few different ways, Monte Carlo, ProjectionLab, NewRetirement, etc... and so far im left with an excess...testing at 100%

The plan is very flexible...

If it makes sense, i could start drawing off from 401k's at 59.5 ...just need to keep the income controlled before 65 for ACA insurance cost.

Any advice on this withdrawal plan would be appreciated.

Still have 1.5 years to tweak...

Looking for input on our plan...

Really, the withdrawal strategy I have in place...

A few details, we will retire at H53/W54

All debts paid off...college, house, cars etc...

Our plan is to pull the trigger in 1.5 years when our youngest graduates college.

Assets 1.8m (500k cash / 200k Roth's / 1.1m 401k's)

Expenses 70k

Healthcare = ACA

SSA at 67years

My biggest question is my Roth conversion plan.

Since we will have no income from approx 53- 65...

We plan to use the ACA for insurance.

-This will be accomplished by making approx 60k Roth conversions annually from 53-65 to show income... (pay the tax from cash reserves)

-We will fill the first "5 year gap" $ with Cash and existing (older) Roth CONTRIBUTION withdrawals...

-In year 6, approx 59/60 we will begin to withdraw the Roth Ladder CONTRIBUTIONS, year by year as they mature until 65...

-At that point we will switch to 401k withdrawals for living expenses, and hold the remaining Roth conversions.

-And of course at 65 medicare kicks in... And SSA at 67.

Ive tested in a few different ways, Monte Carlo, ProjectionLab, NewRetirement, etc... and so far im left with an excess...testing at 100%

The plan is very flexible...

If it makes sense, i could start drawing off from 401k's at 59.5 ...just need to keep the income controlled before 65 for ACA insurance cost.

Any advice on this withdrawal plan would be appreciated.

Still have 1.5 years to tweak...