I have ALWAYS sucked at stock investment. Back in the 80's I had friends beg me to tell them whenever I bought or sold anything, so they could do the opposite. I eventually quit putting money in my IRA because I got tired of watching it go up in smoke when I tried to invest it, or had someone else manage it. It's worth less now than it was in 1990. Thank God for real estate or I'd be flipping burgers in my dotage.

But I've followed TSLA for a long time. Up until Musk's recent shenanigans, I really thought they had it nailed.

* I believe they're the only company that actually sells EVs in quantity for a profit, and they make a fat profit on each car. This gives them tremendous pricing power and leverage.

* They've invested billions back into the company (R&D, gigafactories, etc) and they still have $17B on hand.

* They've beat earnings estimates 8 out of 9 quarters, and just barely missed the 9th.

* While they've partly caught up with demand, they generally have more demand than they can supply. Supposedly the Model Y was the best-selling car (not just EV) in the world in 1Q2023.

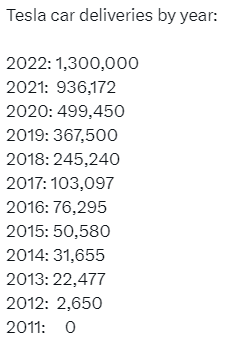

* They're masters at scaling up. They went from "assembling cars in a patchwork production facility in Fremont" to "massive custom gigafactories in Texas, Nevada, New York, Berlin, Shanghai, and Mexico" -- in less than 10 years. They're currently making almost 2 million cars per year.

* They have new products in the pipeline with huge waiting lists -- Cybertruck, Semi, etc. There's a fair chance they'll start shipping those this year, and then they're only limited by how fast they can build them.

And on and on. That sounds to me like a huge winner: customer demand, pricing power, good technology, mostly good execution, etc. I bought some TSLA in 2020 and 2021, with an average price of about $250. My brother the Tesla fanboi (who was managing our mom's estate) insisted on buying a bunch more (1 week before the peak), bringing my average up to $300. Then TSLA tanked for all of 2022, to 66% below my entry price. At the end of 2022 I said "this is a stupidly low price for such a successful company" and I put in a big order to buy at $100. It got within $1.81 of my price and took off.

So you can see what kind of results I get. It's still 18% below my entry price.

Tesla definitely fumbles the ball on a lot of things, and Musk has been an idiot in a lot of ways, but business-wise they seem to be doing well. So why has the price gone sideways for years? Why has their stock gone more or less neck-and-neck with F, TM, GM, etc?

But I've followed TSLA for a long time. Up until Musk's recent shenanigans, I really thought they had it nailed.

* I believe they're the only company that actually sells EVs in quantity for a profit, and they make a fat profit on each car. This gives them tremendous pricing power and leverage.

* They've invested billions back into the company (R&D, gigafactories, etc) and they still have $17B on hand.

* They've beat earnings estimates 8 out of 9 quarters, and just barely missed the 9th.

* While they've partly caught up with demand, they generally have more demand than they can supply. Supposedly the Model Y was the best-selling car (not just EV) in the world in 1Q2023.

* They're masters at scaling up. They went from "assembling cars in a patchwork production facility in Fremont" to "massive custom gigafactories in Texas, Nevada, New York, Berlin, Shanghai, and Mexico" -- in less than 10 years. They're currently making almost 2 million cars per year.

* They have new products in the pipeline with huge waiting lists -- Cybertruck, Semi, etc. There's a fair chance they'll start shipping those this year, and then they're only limited by how fast they can build them.

And on and on. That sounds to me like a huge winner: customer demand, pricing power, good technology, mostly good execution, etc. I bought some TSLA in 2020 and 2021, with an average price of about $250. My brother the Tesla fanboi (who was managing our mom's estate) insisted on buying a bunch more (1 week before the peak), bringing my average up to $300. Then TSLA tanked for all of 2022, to 66% below my entry price. At the end of 2022 I said "this is a stupidly low price for such a successful company" and I put in a big order to buy at $100. It got within $1.81 of my price and took off.

So you can see what kind of results I get. It's still 18% below my entry price.

Tesla definitely fumbles the ball on a lot of things, and Musk has been an idiot in a lot of ways, but business-wise they seem to be doing well. So why has the price gone sideways for years? Why has their stock gone more or less neck-and-neck with F, TM, GM, etc?

Last edited: